There are a few steps you will need to take to access your accounts for the first time.

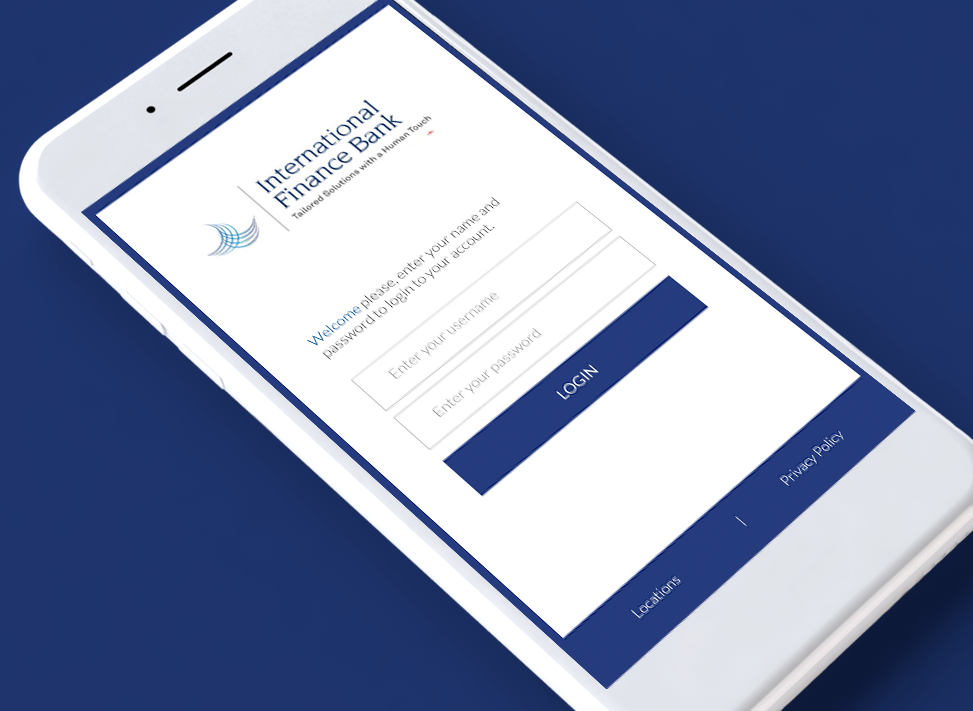

Step 1: When you log in for the first time, you can use your same username. The password will be the one we informed you on the “IFB Digital Banking First Time Login” email.

Step 2: If your current Username and Password do not meet the current criteria, the system will automatically ask you to create new ones. (See requirements below.)

Username requirements

- Must be at least [six] characters long

- Must contain one letter

- Can contain letters, numbers and any of the following special characters: @$*_-=.! ~

- Cannot contain any spaces

Password requirements

- Must be between 8-32 characters

- Must contain following categories:

- At least one uppercase letter

- At least one lowercase letter

- At least one numbers

- At least one special characters

- Cannot contain any spaces

- Cannot contain the username

- Passwords are case sensitive

- Passwords do not expire

- There is no policy about password reuse

Step 3: Review and agree to the new terms and conditions.

Step 4: Select a delivery method to receive a One-Time Passcode. You can either select your phone number or your email. If this information is not available, you will need to contact us at (305) 648-8800.

Step 5: Enter your one-time passcode. You can select to register your computer and browser, allowing you to skip the one-time verification process on that device.